Data Management Best Practices for Accounting Firms

Future-Proof Your Practice.

For your accounting firm, data is the indispensable core of your service, the foundation of every tax return, financial statement, and advisory insight you deliver. Yet, this invaluable asset can swiftly become your greatest liability if it is inaccurate, inconsistent, or fragmented across disparate systems.

In today's landscape, where regulatory scrutiny is intense, and client expectations for both security and strategic insight are soaring, a structured, proactive approach to data management is not merely an operational concern; it is a strategic imperative for your firm's survival and growth.

The stakes have never been higher. As Amy Casey, Director of Finance Master Data at Thomson Reuters, emphasizes,

Data management is critical for accounting firms because data is the foundation for every financial statement, report, and decision we make. Having data that is accurate, governed, up to date, and organized ensures not only reliable reporting and compliance but also enables automation and analytics to run efficiently.

This statement underscores a fundamental truth: clean, reliable data is the prerequisite for every efficiency gain and value-added service you aim to provide.

Part 1: Diagnosing Your Data Challenges

To build a resilient data foundation, you must first understand the specific challenges that threaten data integrity within your firm.

As the gatekeeper to vast amounts of sensitive information, you face pressure from all sides to ensure this data is secure, compliant, and clean.

Each category of data you manage presents a unique set of hurdles:

1) The Chaos of Client Financial Data: Your clients provide information in a chaotic mix of formats, scanned PDFs, photos of handwritten receipts, emailed spreadsheets, and data dumps from various software platforms. This inconsistency is a primary obstacle to accuracy and efficiency.

Standardizing this information for reporting is a manual, time-consuming burden. Furthermore, as your clients' businesses evolve, their historical financial data often becomes trapped in legacy systems or outdated file formats, creating information silos that hinder a holistic view of their financial health.

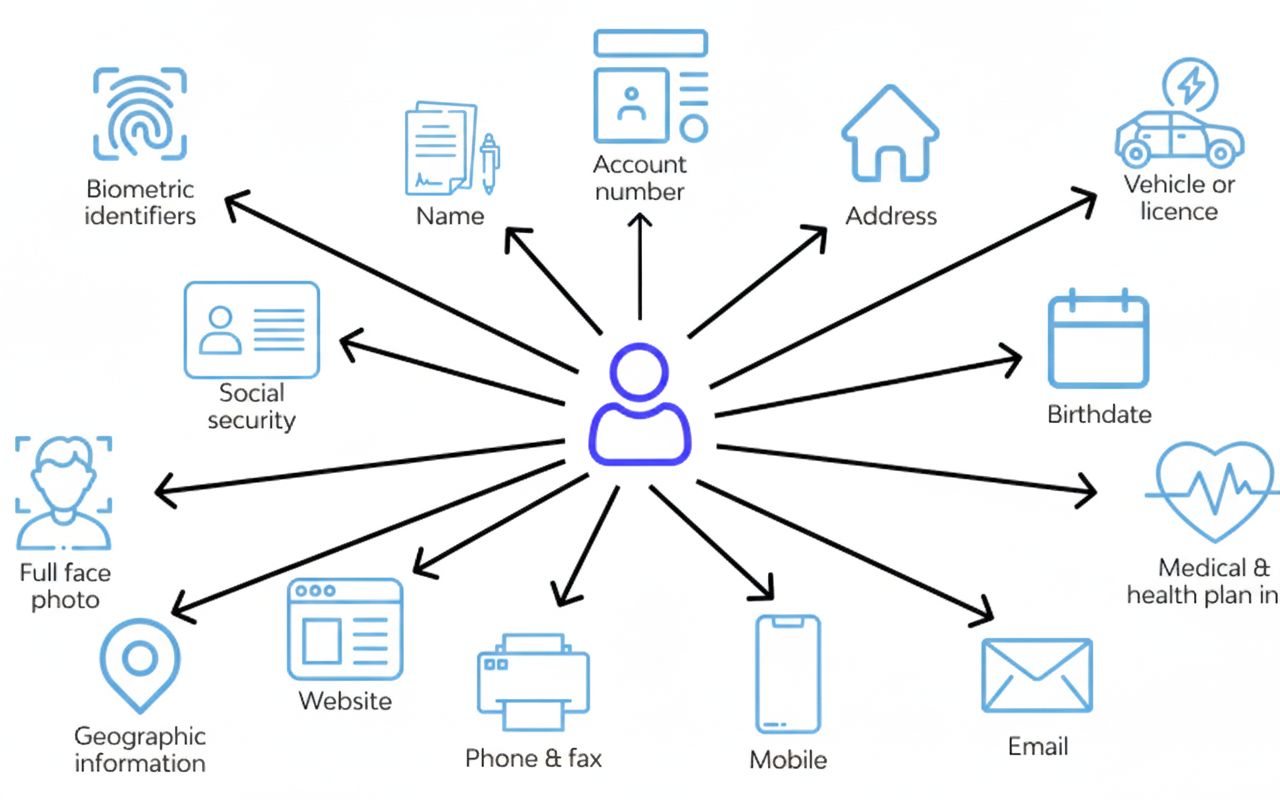

2) The Peril of Personally Identifiable Information (PII): You are entrusted with some of the most sensitive data that exists: Social Security numbers, bank account details, personal addresses, and tax identification numbers.

A breach of this information is a catastrophic risk you cannot afford, carrying severe financial, legal, and reputational consequences.

The challenge is compounded by the fact that this PLI is often duplicated and shared across multiple internal platforms, your practice management software, tax preparation tools, and client portals.

Without meticulous tracking and "data hygiene," outdated PII lingers in forgotten corners of your systems, creating an ever-present vulnerability.

3) The Burden of Internal Records: Beyond client data, your firm generates a torrent of internal information: employee records, engagement files, internal communications, and administrative documents. Deciding what to keep, for how long, and where to store it is a constant struggle.

In the absence of clear, enforced retention policies, your digital systems become cluttered with redundant and obsolete records. This digital clutter slows down your systems, makes finding current information difficult, and significantly reduces operational efficiency.

4) The Legacy Data Labyrinth: Many firms are weighed down by historical data stored in outdated systems or proprietary file formats. As you seek to adopt modern, AI-powered analytics and automation tools, you may find that these new technologies cannot access or interpret your legacy data.

This creates a critical blockage to innovation. You are then faced with a difficult and costly decision: undertake a massive, complex data migration project to bring everything forward, or leave historical data behind and accept the compliance risks and informational gaps that result.

These challenges are not merely technical; they are foundational business issues. The Thomson Reuters Institute’s 2025 State of Tax Professionals Report found that 29% of firms cited a lack of data quality and consistency as a main barrier to automation.

This statistic highlights a direct causal link: poor data management actively prevents you from harnessing the technologies that drive future growth.

Your data management strategy does not exist in a vacuum. It must be constructed within a dense and overlapping framework of federal, state, and industry regulations.

Understanding this landscape is not about mere compliance; it's about building a framework for client trust and operational resilience.

1) Federal Mandates: At the federal level, your firm is governed by IRS Publication 4557, which outlines specific safeguarding requirements for tax practitioners.

More broadly, the Gramm-Leach-Bliley Act (GLBA) regulates how financial institutions, a category that includes accounting firms, collect, disclose, and protect consumers' private financial information.

These are not suggestions; they are legal obligations with clear implications for your data handling procedures.

2) State-Level Complexities: The regulatory web extends to the state level. If you handle the personal information of California residents, you are subject to the California Consumer Privacy Act (CCPA), reinforced by the California Privacy Rights Act (CPRA).

These laws grant individuals significant rights over their data, including the right to know what you collect, request its deletion, and opt out of its sale.

Similarly, if you serve clients in New York, the Stop Hacks and Improve Electronic Data Security (SHIELD) Act requires you to develop and maintain "reasonable safeguards" to protect resident data. The geographic reach of your client base directly determines your compliance footprint.

3) The Gold Standards of Security: Beyond legal mandates, adopting recognized industry frameworks is a powerful way to operationalize security and demonstrate due diligence to clients and auditors.

SOC 2: This auditing framework, created by the AICPA, provides a vital third-party validation that your firm’s systems and controls meet rigorous standards for security, availability, processing integrity, confidentiality, and privacy.

ISO/IEC 27001: This is the international benchmark for an Information Security Management System (ISMS). Achieving this certification demonstrates a globally respected, systematic approach to managing and protecting your information assets.

NIST Cybersecurity Framework (CSF): This voluntary framework provides a flexible, risk-based approach to managing cybersecurity risk. It is an excellent tool for structuring and communicating your security program, even if you do not pursue formal certification.

The most effective strategy is to view these regulations and standards not as a checklist of burdens, but as interconnected components of a holistic data defense system.

A policy built for GLBA will strengthen your CCPA readiness; the controls for SOC 2 align with the principles of the NIST CSF. A unified approach is far more efficient and robust than a piecemeal one.

Part 3: Your Action Plan for Data Cleanliness and Governance

Cleaning your data is not a one-time project; it is the launch of an ongoing discipline of data governance. To improve reporting accuracy, unlock automation, and minimize risk, you must implement sustainable practices.

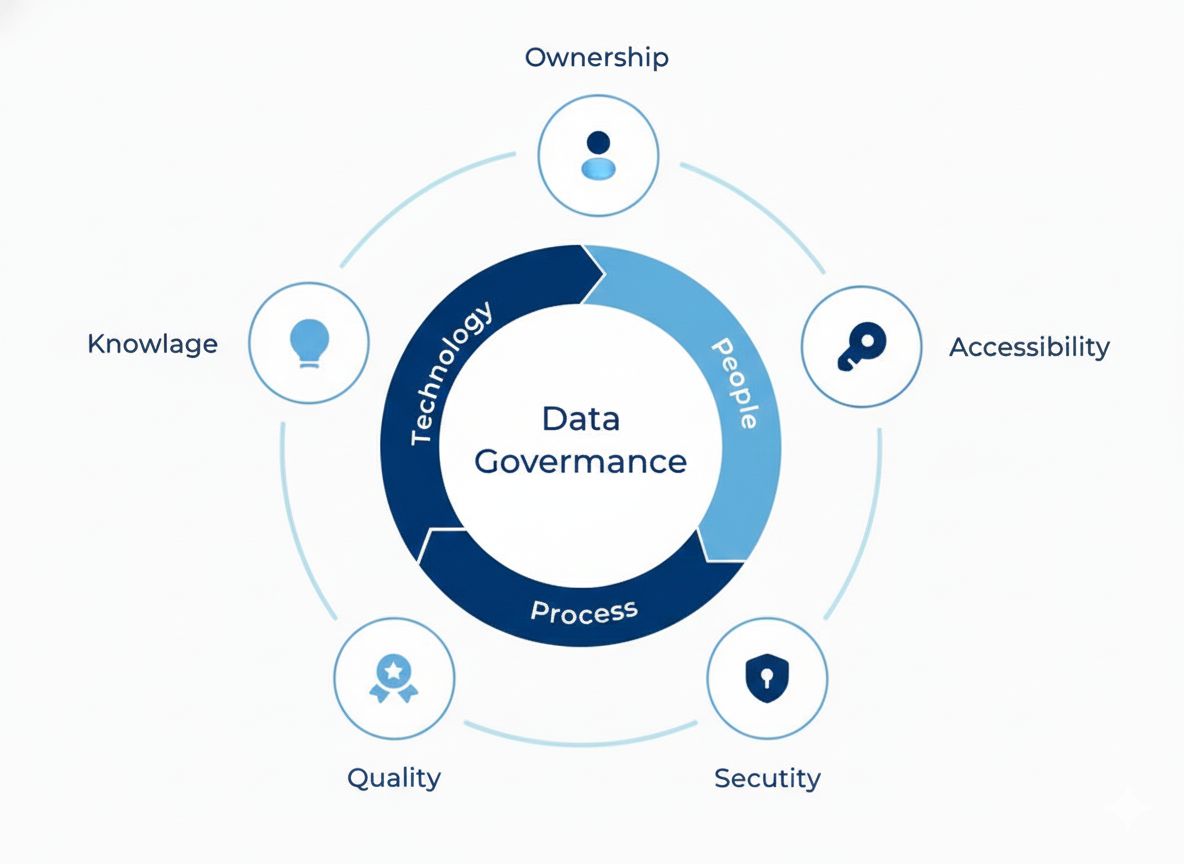

1) Build a Formal Data Governance Framework: Effective data management requires clear rules of the road. You must establish a formal governance framework that defines how data is managed, who is responsible for it, and what standards it must meet.

As Amy Casey illustrates from her experience, this involves creating clear data policies, defining quality standards, and assigning specific roles.

We have data approvers within each business segment, subject matter experts for downstream systems, and data stewards who are responsible for accuracy and maintenance.

Crucially, this framework embeds security roles and audit checks directly into your workflows, ensuring compliance becomes part of the process, not an afterthought.

2) Ruthlessly Purge Unnecessary Data: The simplest way to manage data is to avoid holding what you don't need. Your first step should be to establish clear, written data retention and archiving policies based on business needs and regulatory requirements (e.g., the IRS's general 3-year rule, or specific longer mandates).

In our organization, certain financial data must be retained for 10 years for compliance reasons. After that, we can archive it.

You must then conduct regular, scheduled reviews to identify and securely delete or archive inactive, outdated client and internal records.

This practice, often called "data minimization," directly reduces your system complexity, storage costs, and most importantly, your attack surface and compliance risk.

3) Leverage Technology to Enforce Hygiene: Technology should be your ally in maintaining long-term data cleanliness.

Consolidate with Professional Software: Move away from a patchwork of disconnected tools. Implement a unified, professional-grade accounting platform that serves as a single source of truth for write-up, trial balance, payroll, and client accounting. This eliminates the need for error-prone manual data transfers between systems.

Implement a Secure Client Portal: Replace insecure email and shared drives with a branded, secure client portal. This tool does more than just exchange files; it structures the inflow of client data. By providing clients with specific, organized upload fields, you guide them to provide information in a consistent format from the start, dramatically reducing cleanup work on your end and enhancing their experience and perception of your security.

Part 4: Securing Your Future with AI and Smart Vendor Selection

The future of accounting is inextricably linked with artificial intelligence. The Thomson Reuters 2025 Future of Professionals report confirms this trajectory, finding that 80% of professionals believe AI tools will have a high or transformational impact on their work within five years.

AI promises profound efficiency in tasks like data extraction, anomaly detection, and predictive analysis. However, this powerful new tool also introduces new vectors of risk. Your approach to AI must be grounded in the same rigorous data principles you apply elsewhere.

The single most important decision you will make regarding AI is your choice of vendor. When evaluating any AI-powered or cloud-based accounting tool, you must perform thorough due diligence on the provider's security posture.

Prioritize vendors who can demonstrably prove their commitment to data security. Key non-negotiable criteria include:

SOC 2 Type II Compliance: Evidence of an independent audit of their security controls.

ISO 27001 Certification: Demonstration of a mature, internationally recognized information security management system.

Strong Encryption: Use of encryption for data both in transit and at rest.

Transparency: Clear terms of service and privacy policies that align with your regulatory obligations.

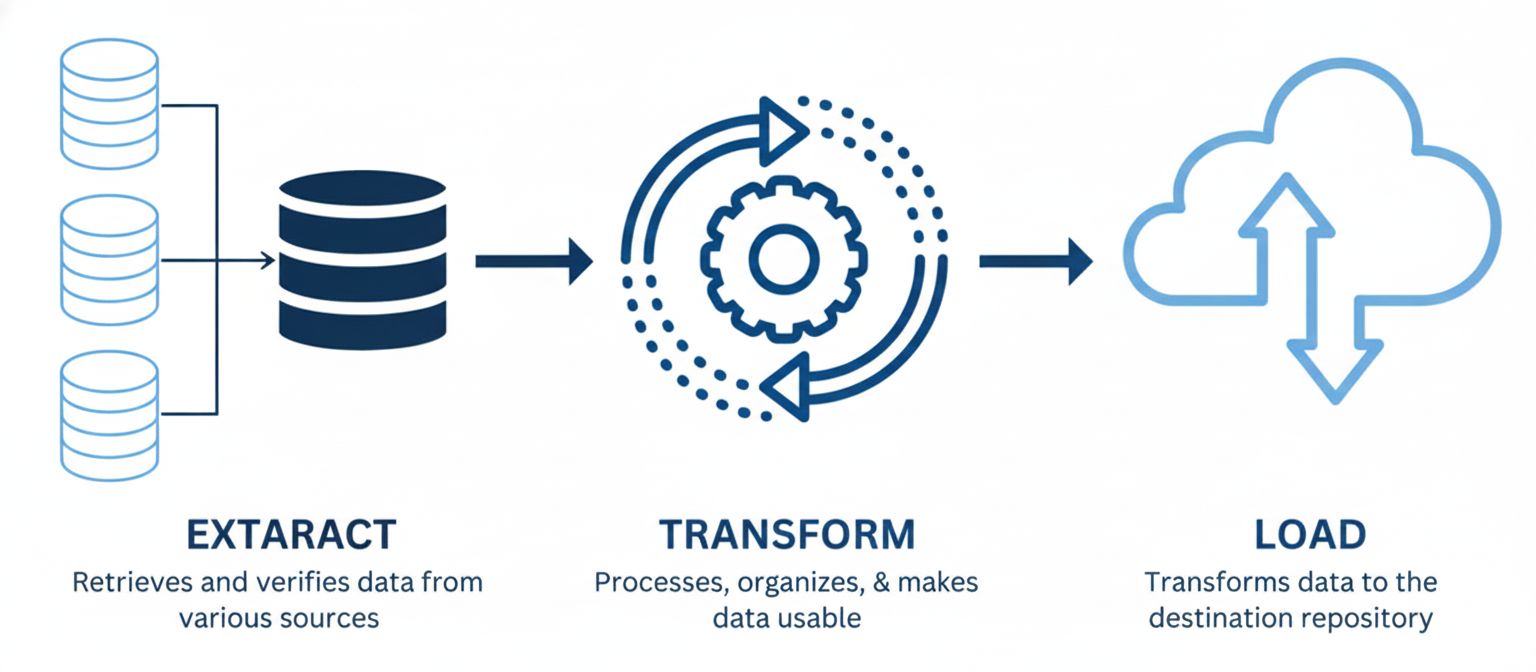

Furthermore, a technology migration, whether to a new practice management suite or an AI tool, is a strategic inflection point.

As Casey advises,

It’s the perfect opportunity to rationalize, cleanse, and standardize data.

Do not simply migrate your existing digital clutter. Use the project as a catalyst to purge outdated records, standardize formats, and establish the clean, governed dataset that will allow your new tools and your firm to perform at their highest potential.

The message is clear and urgent. For your accounting firm, robust data management has evolved from a back-office function to a core competitive differentiator.

It is the essential bridge between the compliance work of today and the AI-empowered, strategic advisory services of tomorrow.

The challenges are significant, but so are the rewards: streamlined operations, unwavering compliance, fortified client trust, and the capacity to deliver unprecedented insights.

Your journey begins with a clear-eyed assessment of your current data state, a firm understanding of the regulatory landscape, and a commitment to implementing the disciplined governance and modern tools that will secure your firm's legacy and fuel its future growth. The time to build your resilient data foundation is now.

Warm regards,

Shen and Team